How this work?

Claiming Your Hidden Treasure:

Join the thousands of self-employed individuals who have

received their share of $600 million in refunds.

LET’S SEE IF YOU QUALIFY

This isn't just any credit; it's a tax credit specifically designed to aid self-employed

individuals impacted by the pandemic. Don't miss out on this opportunity to claim

what you've earned. If you qualify you can receive up to $32,200 in tax refunds.

Claim My Money!

What Is The Self-Employed Tax Credit (SETC)?

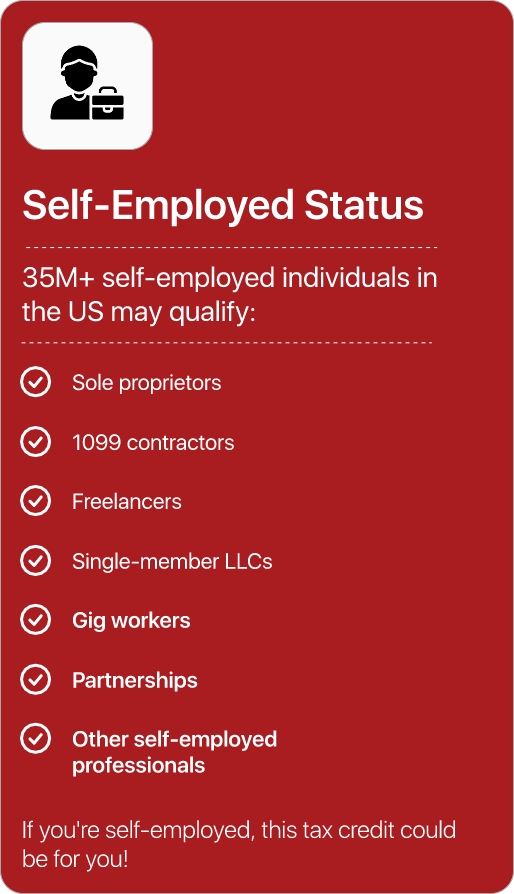

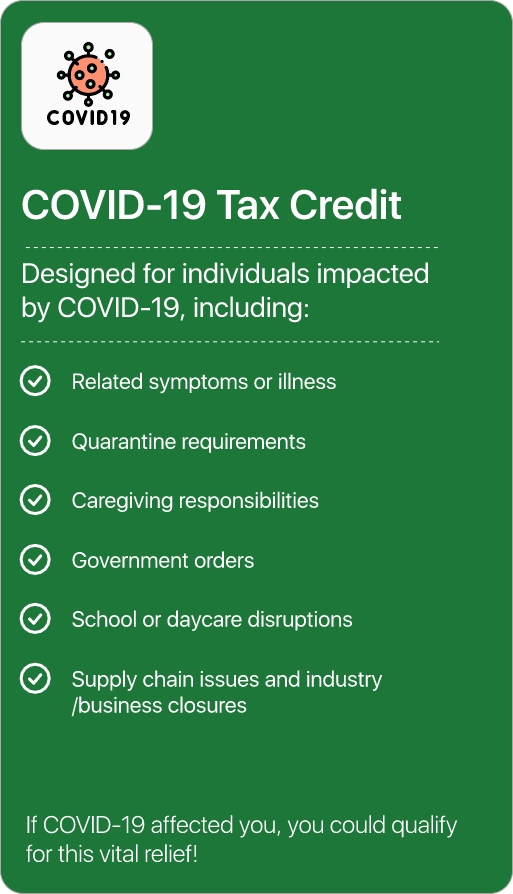

The SETC Program offers a valuable tax credit specifically for self-employed individuals impacted by qualified COVID-19 disruptions, as outlined in the Families First Coronavirus Response Act (FFCRA) and the American Rescue Plan Act (ARPA). Despite its significance, many accountants are unaware of this program, leaving countless self-employed professionals uninformed about their eligibility.

To address this, the government has allocated millions in tax credits for self-employed individuals like you, directly affected by the pandemic.

When we uncovered this hidden opportunity in 2023, we knew things had to change. That’s why we partnered with Anchor Accounting Services to create a streamlined process that has already returned over $500 million to qualified self-employed professionals.

We are proud to be one of the few accounting services in the country dedicated to ensuring this money goes back to its rightful owners. This isn’t just any tax credit—it’s your money, already set aside by the government for you. If left unclaimed, it simply returns to the government’s coffers.

We believe this money belongs in the hands of the hardworking individuals who drive our economy. Don’t let your tax credit slip away—claim what’s rightfully yours today!

Tax Credits For Paid Leave Under The American Rescue Plan Act Of 2021: Specific Provisions Related

To Self-Employed Individuals:

Key Highlights:

1. Eligibility

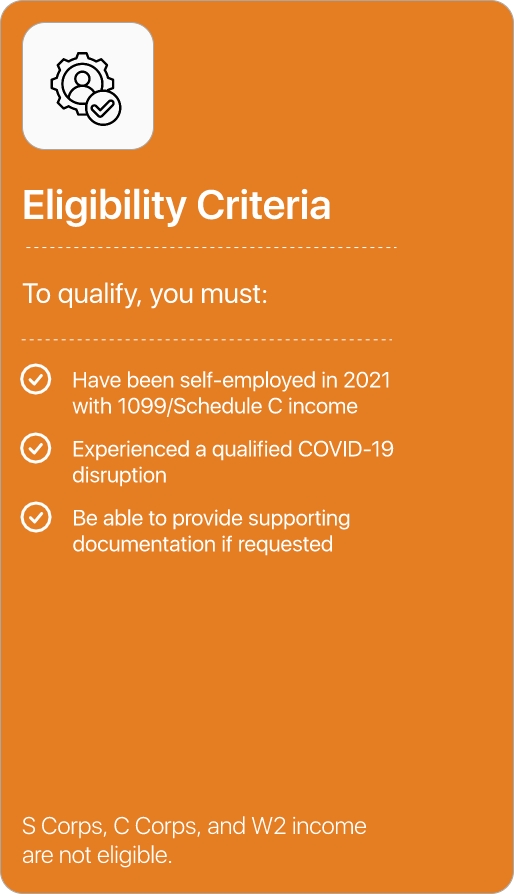

- Self-employed individuals regularly engaged in trade or business under Section 1402 of the Code.

- Credits available for reasons such as quarantine, caregiving, or school closures due to COVID-19.

2. Calculation Of Credits

- Sick Leave Credit: Lesser of $511/day (100% of daily income) for personal illness or $200/day (67% of daily income) for caregiving, capped at 10 days.

- Family Leave Credit: Lesser of $200/day (67% of daily income), capped at 60 days.

- "Average daily income" = Net earnings from self-employment ÷ 260.

3. Dual Income Adjustment

- Self-employed individuals who also receive sick or family leave wages as employees must reduce their credit amounts to avoid exceeding limits ($5,110 for sick leave and $12,000 for family leave).

4. Claim Process

- Credits are claimed on Form 1040 via Form 7202.

- Self-employed individuals can elect to use prior-year earnings for calculations.

5. Corrections And Amendments

- If corrected W-2 information affects claimed credits, file an amended return using Form 1040-X.

6. Pre-Filing Coverage

- Advance coverage of leave equivalents can be handled through estimated tax payments.

For Detailed Forms And Additional Instructions,Visit Irs.Gov.

Irs.Gov.

Minimum Requirements

1. Fast Access to Funds

Government refunds typically take over 5 months, but we believe you shouldn’t have to wait that long for your money. That’s why we established strategic partnerships to streamline the process, allowing you to access your funds in as little as 15-20 business days. What’s the catch? There isn’t one! If you don’t owe the IRS, you’re eligible to request the advance option.

2. Expert Support When You Need It

We’re here to make the refund process seamless for you, guiding you every step of the way. We understand that what seems simple can sometimes be challenging, which is why our team of experts is always ready to assist. Need help? We’re happy to hop on a call and ensure you have everything you need to secure your refund

3. $600M of SETC Expertise

We were among the first to discover the Self-Employment Tax Credit (SETC) and have facilitated over 80% of all SETC refunds issued by the government. This solidifies our position as the #1 expert in the field. Our innovative, user-friendly process has even inspired others to follow our lead—imitation is the sincerest form of flattery!

Unlock the Power of the SETC Program—Simplify Your Taxes, Maximize Your

Refunds, and Take Control of Your Finances with Gig Worker Solutions!

Claim My Money!